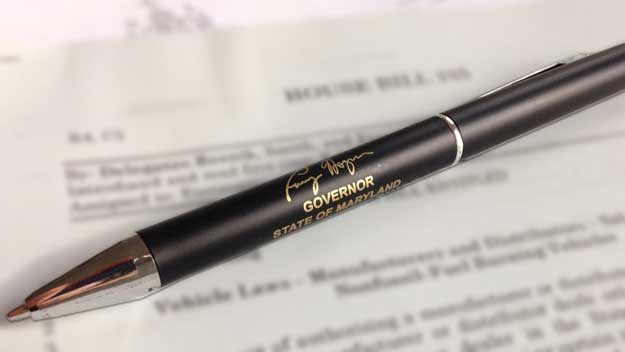

An “anti-ICEing” law is being proposed for the 2017 session of the Maryland General Assembly. The bill, HB 36 [PDF link], has been pre-filed by Delegate Clarence Lam who represents District 12 with parts of Howard and Baltimore Counties. The bill has 12 additional co-sponsors.

This bill is very similar to HB 839 that passed the House in the 2016 session but died in the Senate. This will be the fifth attempt at “anti-ICEing” legislation in Maryland.

The bill, as introduced, will require “green pavement markings” in addition to a sign that meets applicable requirements in order to be enforceable.

Sign and Green Pavement Markings Specified

A sign designating a plug–in electric drive vehicle charging space shall:

(1) Be at least 18 inches high and 12 inches wide;

(2) Be clearly visible to the driver of a motor vehicle

entering the plug–in electric drive vehicle charging space;

(3) State the maximum fine that may be incurred for a violation; and

(4) Meet any applicable state and federal requirements for parking signs.

(D) A plug–in electric drive vehicle charging space shall be indicated by green pavement markings.

Towing Provision Included

(1) A privately owned parking facility may have a vehicle that is stopped, standing, or parked in violation of this section towed or removed in accordance with subtitle 10A of this title.

(2) (I) A parking facility owned by a local jurisdiction may have a vehicle that is stopped, standing, or parked in violation of this section ticketed, towed, or removed if authorized by local law.

$100 Fine for ICEing

A person who violates this section is subject to a civil penalty of $100.

List of Sponsors

Primary Sponsor: Clarence Lam, Co-Sponsors: Tawanna Gaines, Carol Krimm, Karen Young, Terri Hill, Stephen Lafferty, Frank Turner, David Fraser-Hidalgo, Jimmy Tarlau, Eric Ebersole, Shane Robinson, Eric Luedtke and Barrie Ciliberti.

More Details Soon

Stay tuned to @PlugInSites, we expect to report additional details including a hearing date shortly.